Not known Factual Statements About Investment Advisors

Investment Advisors Things To Know Before You Get This

Table of ContentsThings about Investment AdvisorsInvestment Advisors for Beginners

For example, one usual mistaken belief is that pension are actually promised. Sadly, this is certainly not the situation. While some courses provide insurance policy for pension, such as the FDIC for interest-bearing accounts and also the SIPC for broker agents, these plans merely protect versus loss as a result of to failure of the organization, certainly not versus loss because of market conditions. A lot of consider their 401( k)an ensured retirement life financial savings planning. But however, that isnot the instance. A 401 (k)is an employer-sponsored retirement life account that permits staff members to contribute a part of their salary to a tax-deferred account. investment advisors. The cash in the account can easily at that point be committed in various protections, like assets, bonds, and shared funds. The profile worth will fluctuate depending on the functionality of the financial investments. For these causes,

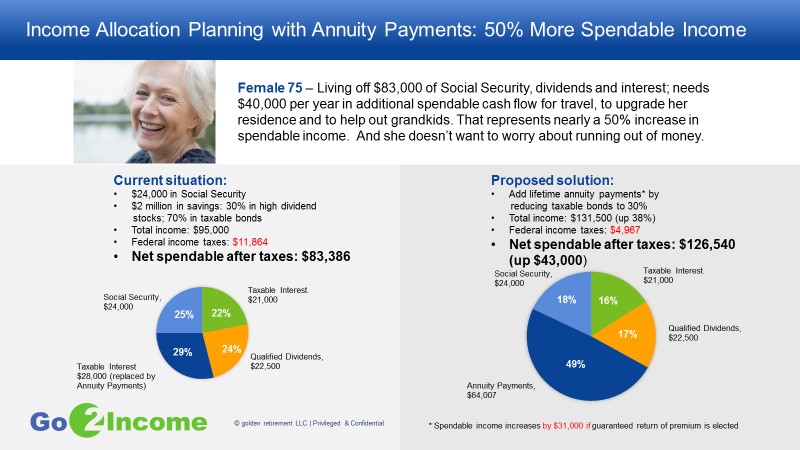

it is actually critical to recognize that a 401 (k)is not a guaranteed retirement consideration. It may still be actually a valuable resource for developing your home egg. Pensions are actually usually forgotten as retired life preparation tools, yet they supply numerous distinct perks that could be exceptionally valuable to senior citizens. Second, annuities are actually tax-deferred, so you will definitely certainly not need to pay for ordinary income tax on your investment till you receive remittances. Pensions supply fatality benefits and also matrimonial advantages that can help to offer monetary safety for your really loved ones. For these explanations, allowances are frequently looked at the absolute most secure individual retirement account. If you're appearing for a risk-free financial investment portfolio that will certainly deliver a surefire earnings stream, a pension along with a life-time profit biker is actually the means to go. Through this sort of allowance agreement, your repayments are actually guaranteed regardless of for how long you reside, so you can feel confident that your retired life financial savings will never ever end. Using this kind of pension, your passion is promised for a set time frame, so you know specifically just how much loan you'll earn each year. Ultimately, if you are actually trying to find an expenditure that has the possible to grow eventually, a set mark pension is actually the appropriate selection for you. Mark annuities do certainly not drop cash to market dryness as well as must certainly not be actually puzzled with a changeable annuity (which can drop amount of money ).

The 20-Second Trick For Investment Advisors

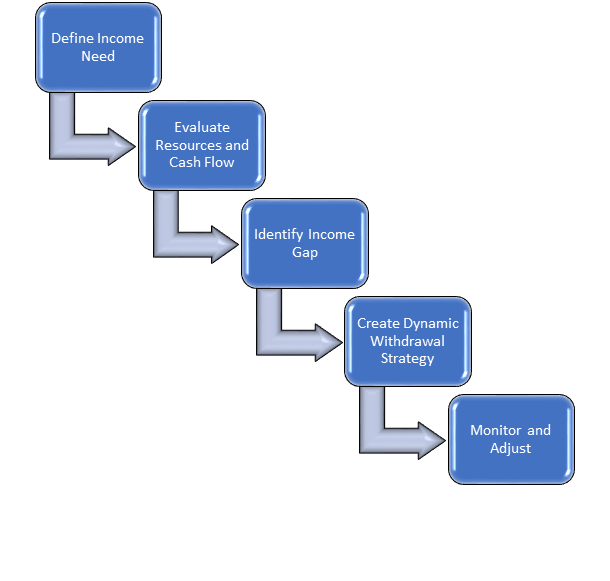

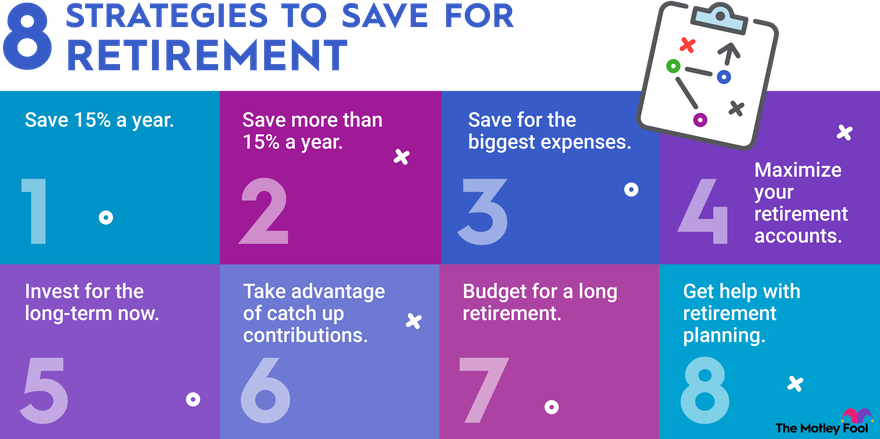

One of the very best means to guarantee a pleasant retirement is to acquire an annuity. Approximating just how much funds you will definitely need to have to barring retirement could be challenging, however our may give you a good idea of what you'll need to have to have actually allocated. As soon as you understand the amount of you need to have to save, you can start acquiring an allowance and also take pleasure in the confidence that possesses understanding you have a consistent revenue flow in retired life. Know just how to intend as well as except for retirement in your twenties, thirties, forties, fifties, as well as sixties. Don't make the mistake of taking SSI early. Put off benefits up until the complete Social Security old age or even age 70. A reduction in perks will certainly affect a personal eventually in lifestyle when lasting treatment is needed to have. On top of that, non-qualified pensions are actually funded through actually taxed cash, and also merely the rate of interest gained are going to be taxed once you generate earnings throughout retired life - investment advisors. The agreement about his is actually that income taxes will only enhance in the future. Much higher taxes lead to a lot less income for the senior citizen. A non-qualified annuity minimizes this threat reviewed to a standard IRA or even IRA annuity due to the fact that simply the interest is actually exhausted rather than the whole entire volume. Connect with us today for a quote if you are actually fascinated in learning more regarding pensions. We will more than happy to review the options offered and assist you locate the most effective solution for your necessities. Thanks for going through! Receive support from a registered economic specialist. This solution is actually cost free. An annuity is an More about the author insurance policy item that can deliver a stream of payments for a collection amount of time or even the remainder of your life. When you purchase an allowance, you pay a swelling sum, as well as the releasing insurer accepts produce routine remittances to you, either for a set duration or even for provided that you stay. For many workers, a standard pension is vital to their retirement preparing. These workplace retirement make use of a pension arrangement to give life time profit to retired workers. Pension benefits may be an essential retirement life profit resource, as well as typical pension are actually frequently among one of the most generous revenue sources on call. As much as this point the majority of our company have counted on a regular, organized income coming from our employer every 2 weeks or even each month. Our advantages were automatically subtracted, and our spending plans could simply be actually thought about. This is still achievable in retired life, yet it calls for some fundamental job to generate these self-paid paychecks for the remainder of our lifestyle. There are a variety of inquiries that require to become addressed when you're intending retirement revenue. 1)Identifying when to resign is a key consider preparing your retired life revenue. While this question might certainly not be effortless, it is essential to examine each of the numerous elements to provide you the opportunity of the greatest retirement life achievable. Period Particular This alternative permits you to obtain a repayment for a specified lot of years.