Frost Pllc Fundamentals Explained

Frost Pllc for Beginners

Table of ContentsThe Only Guide for Frost PllcThe Of Frost PllcAll about Frost PllcThe smart Trick of Frost Pllc That Nobody is Talking AboutThe Frost Pllc Ideas

Keep in mind that CPAs and auditing companies deal with their clients to improve financial practices and guarantee responsibility. In this sense, they are accountable to the public as well as to their clients. Certified public accountants and bookkeeping companies, as qualified specialists with their very own expert codes of conduct and laws, are billed with remaining independent and unbiased, no matter of the degree of monetary review they provide to the nonprofit client.

Freedom RequirementAudit company keeps strict independence from the client to make certain neutral audit outcomes. Freedom is not a rigid responsibility. It allows for closer working relationships with customers. Audit StandardsAudit firm have to abide by International Requirements on Bookkeeping (ISA) as well as local bookkeeping standards. Audit company comply with basic accountancy principles and local regulations.

Examine This Report about Frost Pllc

:max_bytes(150000):strip_icc()/Accounting-FINAL-e01e0f2d93264a989c19357a99d7bffd.jpg)

Bookkeeping companies are subject to basic audit concepts with much less regulatory evaluation. If you want to prepare monetary statements without the need for an independent audit opinion, you should go for audit firm.

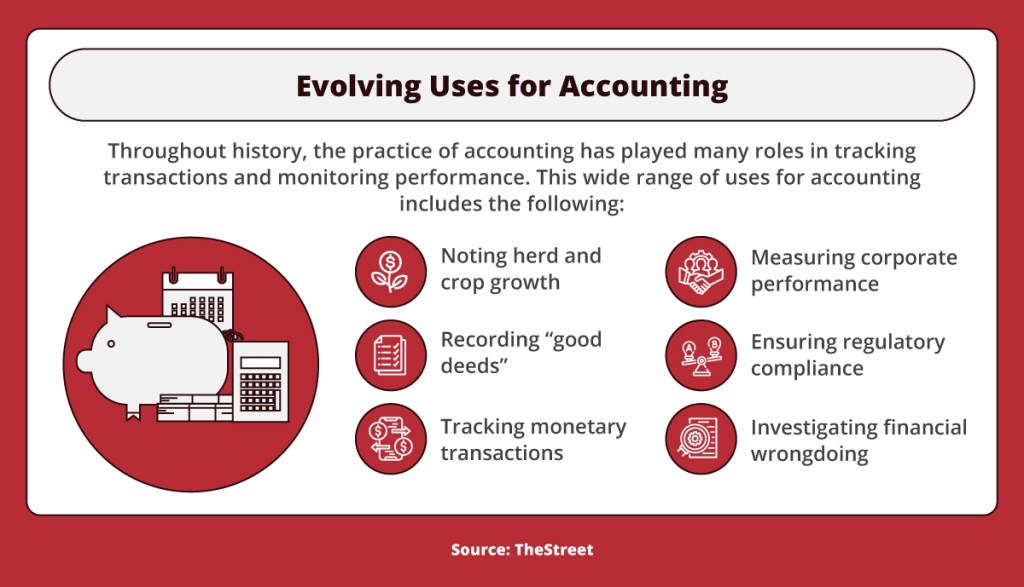

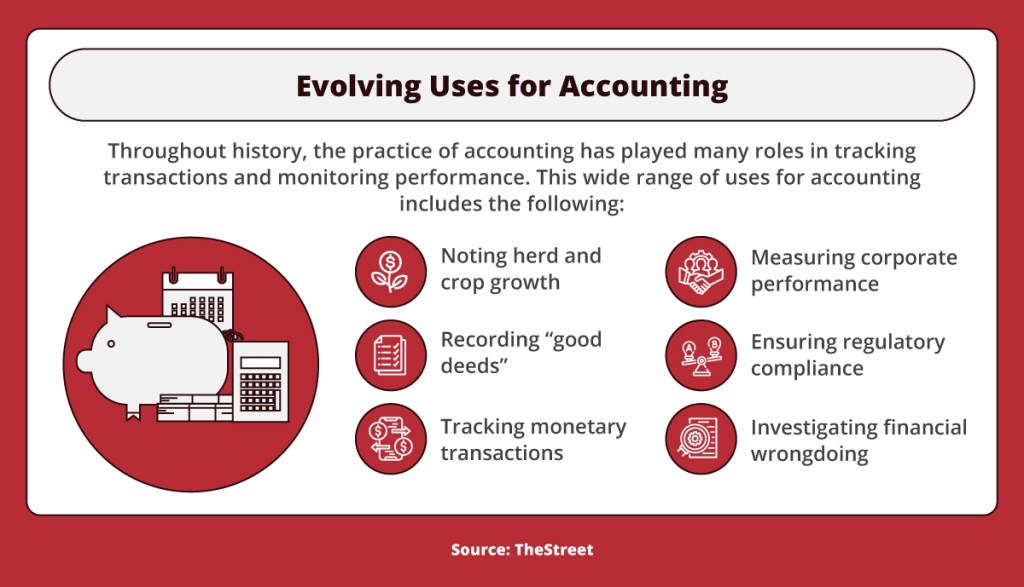

Accountancy and auditing are fundamental in the economic tasks and documents of a business. Accountants are in charge of creating monetary records, observing routine accounting procedures for a firm's procedures, and making and filing tax obligation forms.

They might concentrate on inner or exterior audits (Frost PLLC). it is necessary to note that every monetary auditor is an accountant, but not every accounting professional is a monetary auditor

Accountant operate in companies offering bookkeeping solutions, while business CPAs operate at business selling something various other than accounting services. Company accounting professionals may start with higher pay, though the possibilities for promotion can be leaner. In an accountancy company, on the other hand, development can be fast and there's constantly the prospective to become a supervisor or companion.

Frost Pllc for Dummies

Several current grads select to begin with an accountancy company to build a foundation for later job in the corporate ball. Public audit has the advantage of offering a breadth of expertise, nonetheless, work-life balance can be a beast during tax obligation period. Benefiting a bookkeeping company will certainly see even more variation in hours.

This is a positive, particularly if this is necessary to you. In company accounting, you are making the companyhelping build its future. In public bookkeeping, you just obtain a glance right into a firm but play no active function in where it's headed. In business, hours are much more stable, and adaptable, you start at greater pay, and while development is slower, there are more options of where to go and what you learn.

The accountant may generate additional records for unique functions, such as establishing the earnings for sale of a product, or the incomes created try here from a particular sales area. These are generally taken into consideration to be supervisory reports, rather than the financial records released to outsiders. An example of a managerial report shows up in the adhering to exhibition, which displays a flash record that details the vital operational and bookkeeping issues of an organization.

C corporations frequently simply referred to as firms are public business that are legitimately separate from their proprietors in such a way that is various from any various other type of company (Frost PLLC). In the situations of LLCs and restricted obligation partnerships, proprietors are different for the functions of responsibilities, however except profits and losses

The 45-Second Trick For Frost Pllc

First off, some corporations can sell business supply in the securities market. When somebody acquires supply in the company, they turn into one of the firm's proprietors (aka a shareholder). Companies commonly have several owners. Companies likewise pay tax obligations differently than other types of firms. For various other organization structures, the owner can treat business earnings as individual income for income taxes.

A corporation, on the other hand, have to pay tax obligations on its revenues before it can distribute them to the owners. It'll have to pay the 2020 corporate tax obligation rate of 21% on find here those earnings, leaving it with $395,000 after tax obligations.

Some companies, if they fulfill certain requirements, could select to operate as S firms. This arrangement enables them to avoid dual tax. Instead of paying company taxes, the owners of the firm pay taxes on the firm's revenues through individual income tax obligations.

How Frost Pllc can Save You Time, Stress, and Money.

From high-income tax obligation preparing firms to actual estate tax firms, whatever you are looking for, there is a particular audit firm for it. These firms execute audits of companies, organizations, tiny businesses, government her response entities, and individuals. Generally, these companies will always have some company. These companies are needed to perform yearly audits in most places.

Just like the other types of accounting companies, audit companies can be damaged down further in specialty companies. Little niche-based firms like this are a terrific method to obtain the most very trained accountants for a specific work.